What Are the Top Consumer Trends of 2025?

January 21, 2025

Does it feel like life seems to keep getting stranger, faster? In times that get more unprecedented every day, the way business and the public interact is in a constant state of shift. It’s easy to feel overwhelmed. But never fear – OUTFRONT is here – and we come bearing trends!

Introducing OUTFRONT’s 2025 Advertising Trends Report, containing 50-plus pages of actionable insights, emerging opportunities, and industry observations, curated to help advertisers better reach, engage, and activate their audiences. So what are the top consumer trends of 2025? Here are the five that advertisers need to know.

The incoming Trump administration will be greeted by economic optimism.

Though consumers are still stinging a 17% cumulative increase in the cost of living over the past two years, the incoming Trump administration will inherit an economy on the mend, with projected 2.0% growth and 2.3% inflation. Consumer sentiment is rising too, with 40% saying they’re doing better this year than last and even more – 50% – saying they expect to do even better financially next year.

While it remains to be seen what economic policies will emerge from the Trump administration, tariffs and other actions could create change in the competitive landscape, so brands and local businesses should stay alert for opportunities to go on offense – or threats from which they must defend.

(SOURCES: The Conference Board, Forbes, Mintel)

Feeling vulnerable to extreme weather, consumers expect businesses to step up.

With massive hurricanes and out-of-control fires dominating headlines, climate change and its impact can no longer be ignored – something must be done. So say consumers, who see sustainability as a responsibility shared with business. Seven in ten consumers say large business needs to do more. Meanwhile, in their own lives, willingness to spend more for sustainable products has increased, particularly in CPG and auto categories.

Consumers overwhelmingly expect businesses, both national and local, to step in and pitch in during the recovery phase. However, for categories like home improvement that people depend on most after disaster, establishing a physical presence in the community before one strikes can build name recognition and trust, ensuring that when people are in panic mode looking for someone to help, yours is the first name they turn to.

(SOURCES: Bain, Ipsos, Gartner)

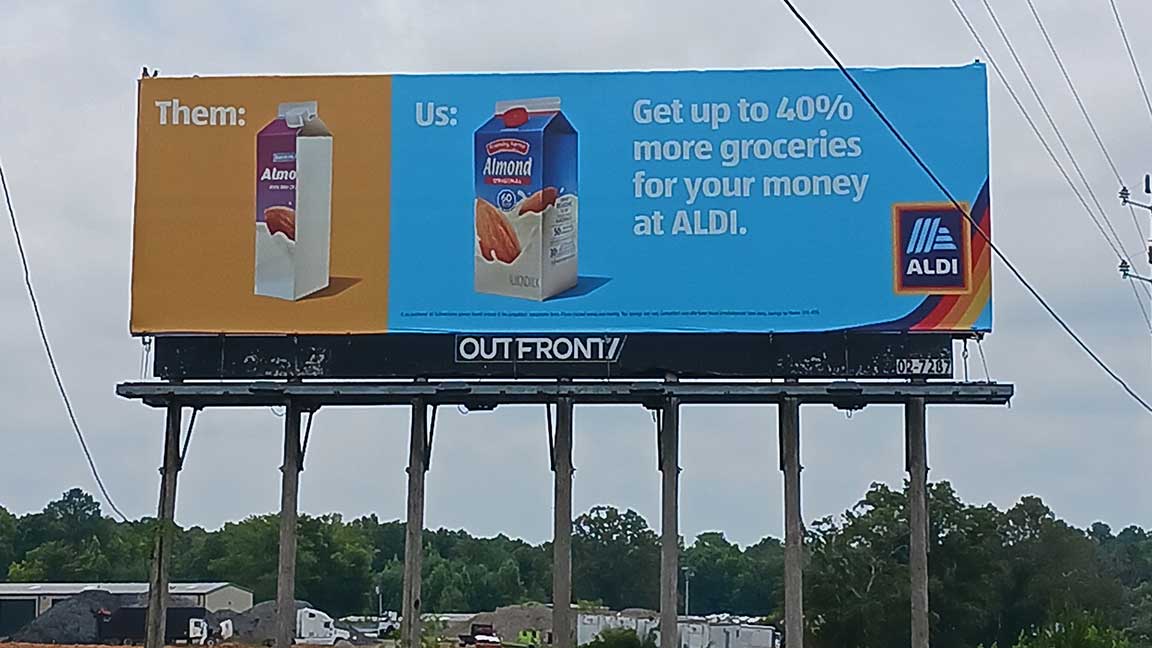

Store brands (aka private labels) help us stick to inflation-battered budgets.

Inflation has of course impacted the way we shop, and in essential product categories where cutting back purchases isn’t realistic, store brands – also known as private labels – help shoppers bring home high-quality products at reasonable prices. While private labels represent the majority of sales at retailers like ALDI and Trader Joe’s, they’re everywhere from Amazon to Walmart, with a presence in every category that gets consumed. How big is that presence?

It's near-universal. Private labels have penetrated 99% of the household and health/beauty categories and 100% of the grocery market; collectively they now claim up to 38% category market share. And while private brands possess the advantage of access, they face many of the same challenges as name brands in terms of driving awareness, consideration, and intent.

(SOURCES: Numerator, Mintel)

Consumers’ mistrust of AI limits scope to low-stakes, high-effort tasks.

Artificial intelligence is everywhere, seemingly overnight. What are consumers using it for? Thus far, the top use cases include travel booking and shopping assistant functions like price comparison (36%), search (29%), and recommendation (26%). Each represents a labor-intensive task where the incremental work may not be worth the benefit.

However, when it comes to functionalities like financial, legal, or medical advice, even those early adopters who have embraced it elsewhere are only half as likely to trust AI in realms like these where the stakes are higher. To expand its adoption, artificial intelligence must calm consumer concerns about bias (31%), ethics (21%), and accuracy (43%).

(SOURCES: NielsenIQ/GFK, eMarketer, YouGov, PwC)

Millions of workers are returning to office and riding transit.

Amazon and Dell are the latest join the ranks of employers implementing full return-to-office policies. Overall, the majority of workers goes into the office at least three days a week at the time of this writing, while a potential Federal RTO mandate could affect two million more.

The shift in return-to-office policies is reflected in the surging growth we’re seeing in transit ridership. In fact, New York’s MTA set a post-pandemic leadership ridership record in December and eight of OUTFRONT’s transit partners have notched double-digit ridership growth through Q3 of last year!

(SOURCES: Flex Index, MTA, APTA)

Those are the top consumer trends for 2025. Coming up on Brand Central Station we’ll cover the latest 2025 advertising media trends and out of home advertising trends. Don’t want to wait? Download the full report here.

Author: Jay Fenster, Marketing Manager @ OUTFRONT

Links to third-party content are not endorsed by OUTFRONT Media. Past performance may not be indicative of future results. OUTFRONT does not guarantee specific results or outcomes.